How to invest

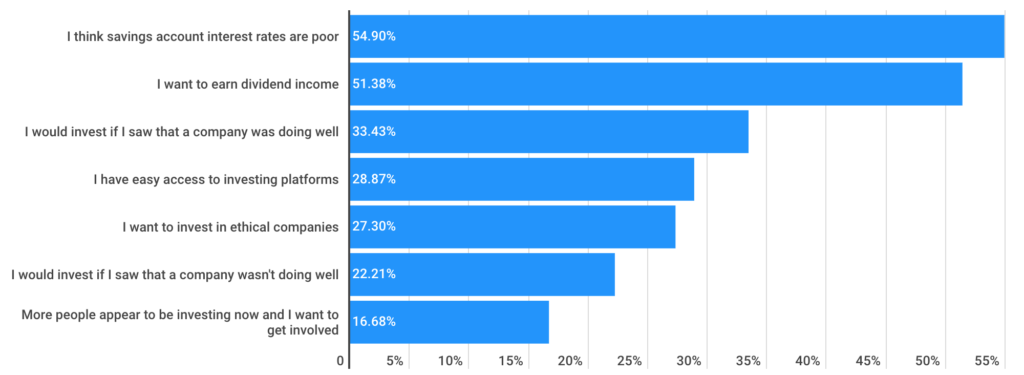

A really interesting survey was done by www.finder.com on what percentage of the UK population invests in stocks (ownership in companies listed on public financial markets) – the results are noted in the bulletpoints below:

- 33% of Brits owns shares.

- 2.2 million people in the UK were subscribed to a stocks & shares ISA account in 2019 (3% of the population).

- Only 43.5% of these ISAs were held by women (957,000).

- While 56.5% of stocks & shares ISAs were held by men (1.25 million).

- The average stocks & shares ISA account is worth £27,000.

- Men have slightly more money in their stocks & shares ISAs, at £29,500 compared to £25,800 for women.

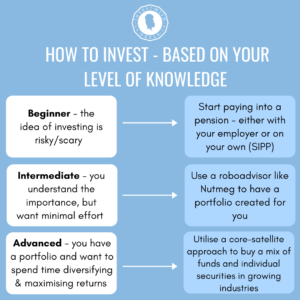

Many of you may be wondering how to start investing and it is simpler now than ever before – regardless of your knowledge level, as illustrated below:

👶🏾 For beginners the easiest way to start is by making sure you take advantage of a pension. This is just a pot of money that is invested into different assets over the long term to provide you with money when you retire. If you work for an employer who matches your contributions this is essentially free money! Adding to that the fact the money is allocated pre-tax and your money grows exponentially over time it is important to start as early as you can. If you are self employed then you can also set up your own pension pot – a self invested personal pension (SIPP).

😎 At the intermediate level you have a good grasp of the concepts of investing and understand it is a key part of building wealth and planning for the future. You may not know everything about different asset classes, but you have important financial goals to work towards. The easy option is to set up an account with a roboadvisor like Nutmeg and set up automated monthly direct debits for investing. You may also even have a brokerage account and dabble in buying assets yourself. See the link at the bottom of this article to create a Nutmeg account and take advantage of reduced fees.

🤓 Advanced investors have their own brokerage accounts and cover a range of asset classes. They weigh up the pros and cons of investments and decide for themselves on what to include in their portfolios. To maximise returns I would suggest allocating a large portion of your portfolio (the core) to low cost index funds and then the remainder (satellite) to individual securities or alternative assets that you have researched yourself. For the very advanced you may even choose to have a small allocation to volatile stocks that are more risky but potentially provide much higher returns.

As always, please let me know if you have any questions. Happy investing!

Nutmeg: https://nutmeg.mention-me.com/m/ol/wz7yx-92f494f9e0

Disclaimer: The mention of a provider is not a recommendation to invest. Please note that with investing, the values of your assets can go up as well as down. This article serves as financial guidance only and you should always do your own research.