How I set my investment goals for 2020

What goals did you set yourself for 2019? Did you achieve them? Were there any investment specific ones? Well if not then this is the year that we work to #securethebag. I know December is a tricky year to think about goals because the motive right now is to eat everything in sight, watch Christmas movies and worry about how to stretch that December pay check through the long, cold weeks of January.

However, as with most things – the more you plan, the better your situation will eventually turn out.

Every year I set some goals and now that I look back I realise that they have always been to invest in some way or another. For example, this year I set out some goals to invest in myself with regards to my fitness – I ran a 5.6k race (the JP Morgan run) which is a distance that I haven’t done since school. I also started going to the gym on some lunch breaks. The gym I’ve signed up to is expensive but I am happy to take the hit because it is right next to my office so I rarely have a real excuse to not go. Health is wealth and so I am happy to invest in my gym membership (not that this is necessary for everyone – if you know you can be motivated to exercise without a gym membership then you do you!). This year I also set out some financial goals. Each month I take 40% of salary and put it directly into investments. I also put about 15% into my savings pot. I had a set figure for how much I wanted to save this year and managed to achieve it – not by doing anything necessarily remarkable, but just by being organised and putting things into place at the start of the year. Simple things like automating my payments and researching what I wanted to invest in beforehand. If you have a specific asset class in mind that you want to invest in – equities for example, then you need to have an action plan to achieve this. Another goal of mine was to invest in different sectors of the equity markets so I took the time to figure out what type of assets I wanted to put money into at the start of the year and once I had the money I could put it to work straight away – this year I had quite a big focus on technology. There have also been goals where I put other people at the forefront. In 2018 I wrote a list of names of people that I love but rarely ever see and made a conscious effort to contact them at least once a month. Investing time and effort into your relationships with people can’t necessarily be quantified in terms of returns, but it is one of the most rewarding things you can do.

So, what’s the plan for 2020? Well this year I will be splitting my goals into three topics as per my blog theme – ‘Investing in myself, others and assets’. Writing this will be useful as I can either look back in a year’s time and laugh at my failures or realise how planning ahead brought about success – hopefully it will be the latter. It also provides a framework for you to set your own investing goals. I think the easiest way to set some goals is by choosing one goal for each of the aforementioned topics:

· Myself: one goal that focuses on how you can further your own personal development – perhaps by taking on a new qualification or working on your health and fitness.

· Others: a goal that focuses on how you can invest in somebody else. It could be supporting a friend’s business, carving out more time to support family or volunteering with a charity that is close to your heart.

· Assets: a final goal that makes your money work harder. Instead of keeping your money in a savings account you may decide to take a big step and actually invest it! With bank savings rates at almost zero and inflation at 2% each year, any money you leave in the bank actually goes down in value over time. This year you could decide to put your first £50 into the stock market, property funds or even your own business.

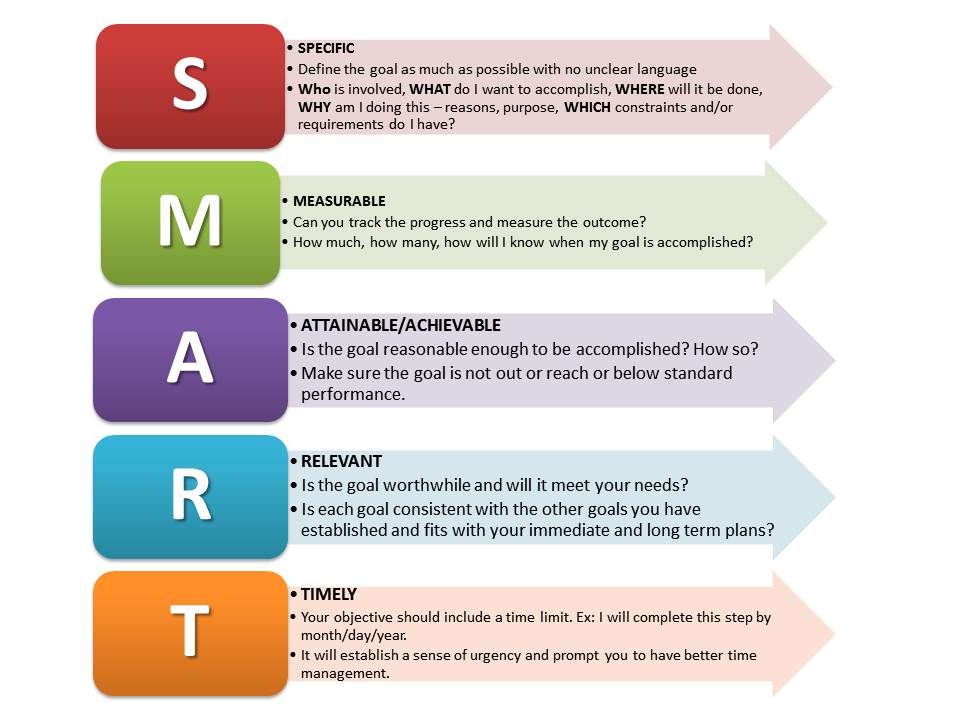

When setting a goal it is good to make it a SMART one. SMART stands for:

I have set quite a few SMART goals for 2020 and you can see a few of my examples below:

– Investing in myself: Improving fitness – take part in an aquathlon in London by the end of summer 2020.

– Investing in others: Dance ministry – hold rehearsals at least once a quarter to help people express the holy spirit through their body movement.

– Investing in assets: Allocate 5% of my salary each month specifically to commercial property funds with a yield above 4%.

I hope reading my investing goals for 2020 motivates you to set your own! Please share your goals in the comments below and have a look back in a year to see how far you’ve come. Merry Christmas and Happy New Year to you all.