What percentage of your income should you be investing?

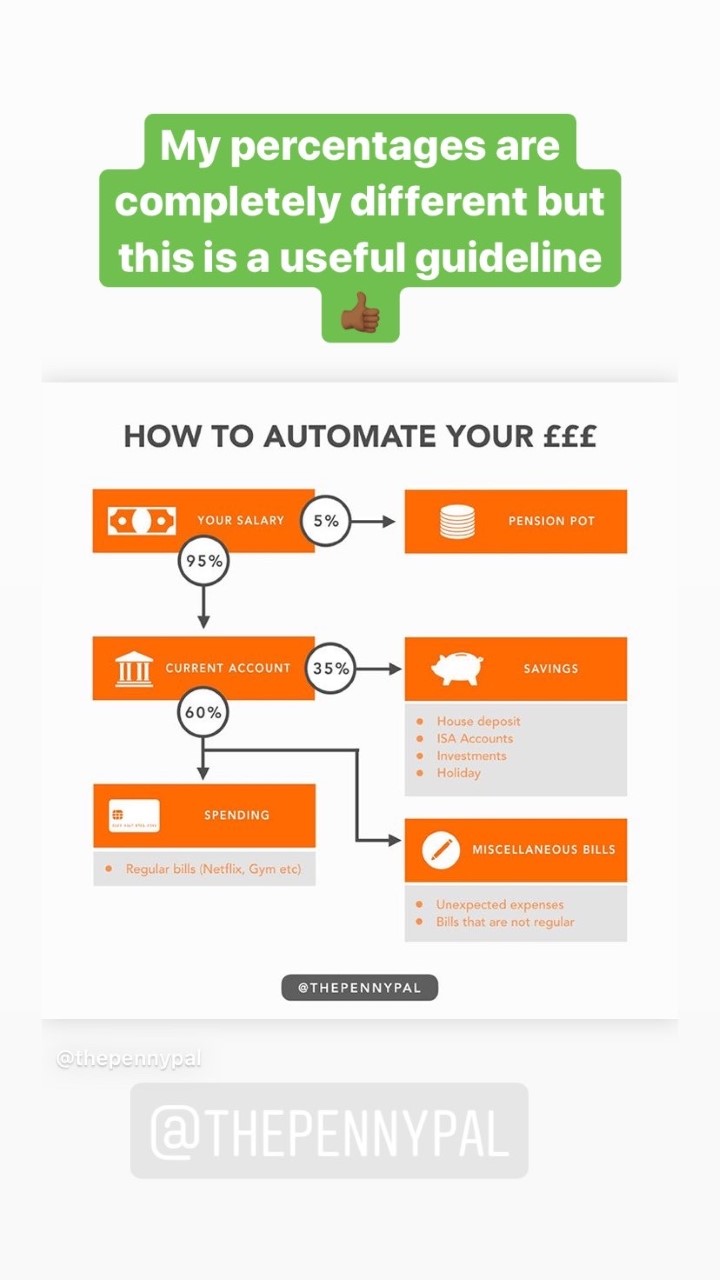

I love sharing investment guidelines and general financial insights on my social media feeds because it gets people engaged and motivated about their own situations. A few weeks ago I shared the photo below on my Instagram story and ended up with all sorts of feedback:

Some examples of feedback:

Exhibit A

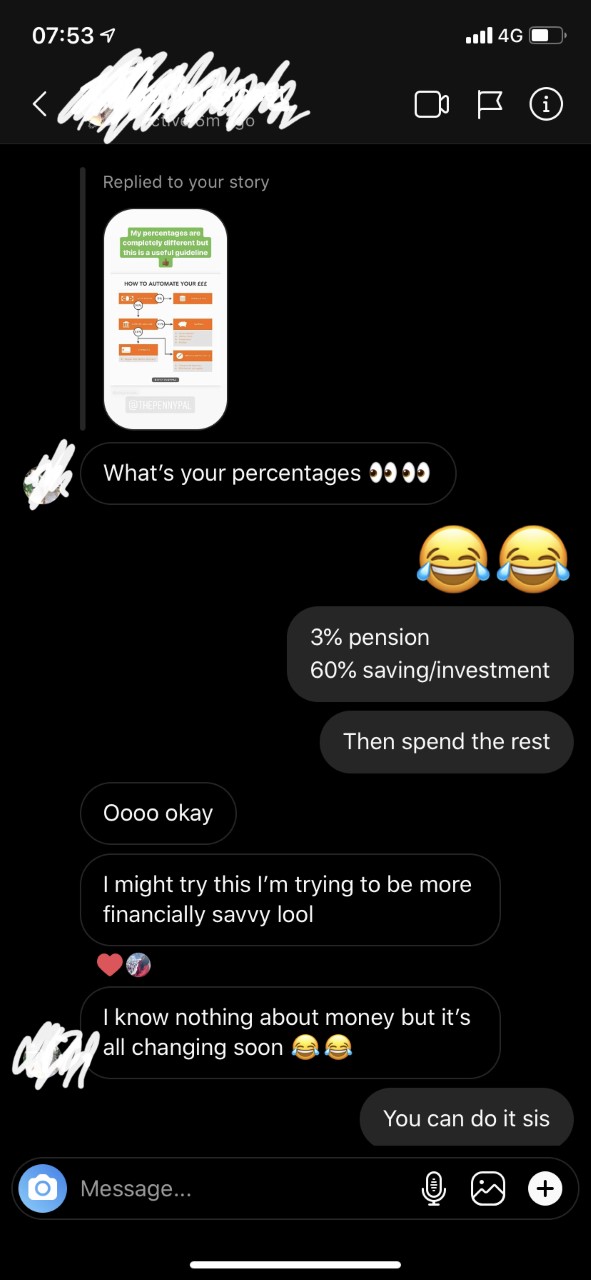

Exhibit B

Exhibit C

As you can see, the responses ranged from full agreement to outright scepticism, which is absolutely justified. When browsing through the internet there are various financial gurus that have their own take on how much you should be saving etc. The 50/30/20 rule says that you should, ‘reserve 50 percent of your budget for essentials like rent and food, 30 percent for discretionary spending, and at least 20 percent for savings’. There’s also the 70/20/10 rule for living expenses, savings and paying off debt respectively. Everyone is different but, as I’ve said before, most of the people that read this blog are under the age of 35 and are consequently young enough to invest more of their money and should be doing so. The older you get, the less time you have to take advantage of compounding (which is when your investments grow to produce very high returns over a long period of time) so the earlier you can get started, the better.

Having that in mind, I think it may be helpful to share what my breakdown is. If I was to create my own diagram a la @thepennypal, it would look something like this:

- Pension pot (3%) – my employer matches this so if I pay in £1 they pay in £4. It is basically free money and we should all be paying into our pensions.

- General savings account (7%) – you should really have enough for about six months of living expenses saved (if you have no dependents and live at home then I think three months should suffice).

- Set expenses (25%) – These are the things that I have to pay for each month without fail. It includes things like travel to work, gym membership and tithes.

- Free Spend (10%) – this is the money that I am free to pretty much do anything with. All my spending goes on my credit card and then gets paid off completely the following month by an automated payment (apart from in December when I seem to lose all control and spend recklessly 🤷🏾♀️ – please be better than me.

- Invest (55%) – this money goes straight into mutual funds, REITs, individual stocks, roboadvisor portfolios etc. If there are months where I have a bit of extra income from somewhere then that generally gets added to investments as well.

I will note at this point that these percentages aren’t set in stone, there are fluctuations across the months depending on how much I suddenly start hitting up my old friend Uber Eats or impulse booking holidays (Afronation I’m looking at you). Broadly speaking though, my investments generally take up the largest proportion of my income.

As you can see in the diagram that I’ve drawn there are a few differences to the Penny Pal version. The first and most important one being that I don’t pay for Netflix 👀 . The second being that I personally think it is quite important to draw a distinction between savings and investments because the two are very different. A lot of bank accounts right now have very low interest rates which means the value of your money is either falling over time or just in line. However, when you invest you have the opportunity to actually grow your money. Of course there is the risk that your capital could fall in value but ultimately – coming back to my point about us being young – you can see a drop in the stock market as an opportunity to buy more assets at a cheaper price. Then over the long term you can still make decent returns. The key is to stay invested for a long period of time – five years plus.

We are all different and will have varying percentage splits so I challenge you to have a think about what your percentage splits are and then if you haven’t already, start to allocate a small percentage of your income each month to some sort of investment. Let me know what your splits are in the comments!