UK Elections – What impact will your vote have on your finances and investments?

Now I am sure we all feel like we have had to vote quite a lot over the last few years (those of you who don’t vote obviously can’t relate), but clearly the decision over who rules our country is an important one that we are all privileged to be a part of. There are people who protest and die for that right all around the world so instead of complaining that all ‘politicians are the same’, it’s great that we can actually get involved in the process and make an impact. See the following chart for further guilt-tripping along with a quote that is apparently from Leonardo da Vinci – it’s on the internet so it must be true.

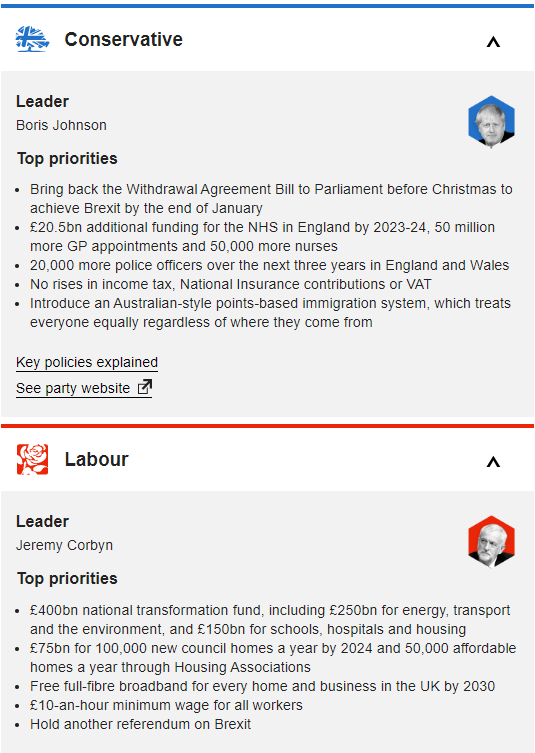

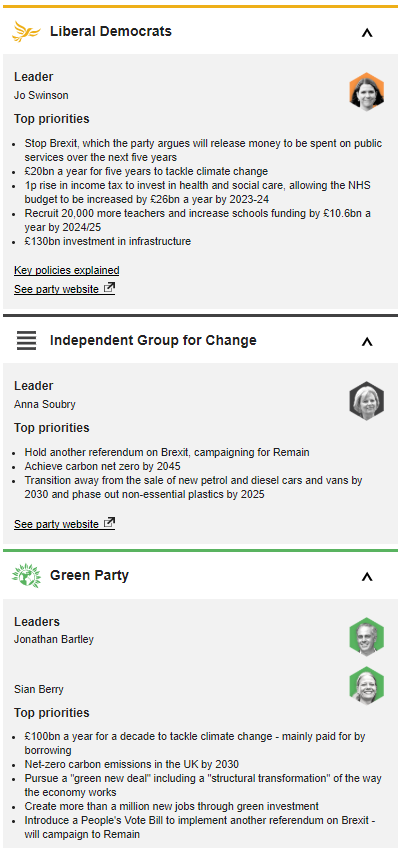

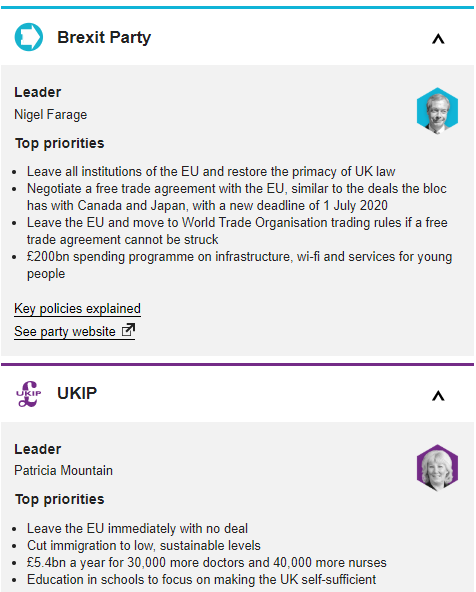

Now that I’m done convincing you of how important it is to actually vote, what impact will your vote have on your investments? There are several parties to vote for, each with their own manifestos. I’ve managed to find a nice little collection of summaries of the main points from each party’s manifesto, courtesy of the BBC:

So just scanning through these, if we are thinking about finance and investments, the topics that seem to come up most frequently that will affect us in this respect are:

- Brexit

- Taxation

- Government spending/investment

With any uncertainty in geopolitics over the short-term, we tend to see a move in financial markets and the extent to which this happens depends on the outcome. We saw immediately after Brexit the value of the pound plummet (which basically meant we had to spend more money when we travelled overseas). One good thing that happens when the value of the pound falls is that any earnings we make in another currency are relatively higher in value. When we think about the main index for UK companies – the FTSE 100 – we see that over 70% of these companies actually earn their revenues in dollars so any fall in sterling would lift these share prices. If we were to see a strengthening of the pound this would be more helpful for our economy in general as we would feel relatively wealthier which would lead us to spend more. Whenever you spend money you are giving somebody income and so we would see potentially see an increase in overall economic activity/growth. Looking at the party manifestos there are options that range from outright defying the referendum vote to remain in the EU, to a hard Brexit. Realistically it will be difficult to arrange any final outcome on this, but the main thing is certainty. People generally dislike uncertainty and it stops them from investing and spending. Once people are actually clear on what is happening then we are likely to see more positivity and definitive action taken. For example, overseas property investors in the UK market may look favourably upon a soft Brexit/remain decision and decide to finally invest their money once the housing market stabilises. This could see house prices begin to rise, which begs the question: does the current uncertainty provide an opportunity to get good deals on property?

With regards to taxation, this has been a very contentious topic. As you can see above, the Conservative party will not be changing any taxation levels. Labour in contrast have spoken of the move to increase income tax for people earning over £80k – who apparently make up the top 5% of the population. People like the guy on Question Time, who is probably still confused right now bless him. Clearly this will probably upset people who are earning/planning to earn more than £80k and leave everybody else wondering what exactly will be happening with all this extra government revenue.

Which brings me nicely onto the final topic of government spending/investment. There are some wildly exciting proposals from a few parties here – £200bn on infrastructure and wi-fi? We all love free wi-fi (quick check that you’re using your wi-fi and not your mobile data – you’re welcome). Billions more on investing in the NHS and housing, not too shabby. Then there is also talk of nationalising companies, utilities and the railways in particular. This is a tricky one because one view is that governments are not too great at running companies and that this should be left in private hands. This would then allow companies to benefit from natural monopolies and generate more profits, thus creating more jobs and prosperity. The other view is that corporations are greedy and that these profits don’t trickle down to everyday workers. Depending on which party comes into power, there could be a big change in government spending and the way that these companies can operate. It is important to note that whilst parties can promise to deliver on spending, this is subject to whether they actually have enough funding to carry this out. With the high levels of debt we are seeing in government at the moment, it is unlikely that we will see large amounts of spending actually happen.

In conclusion, depending on who gets into power there will be varying impact on your finances and investments. It is important not to get caught up in trying to make any big decisions now as it can be easy to get caught on the wrong side of market volatility. A good idea would be to check that your portfolio is sufficiently diversified and if you don’t have one yet, you could start thinking about how you can begin to hold a collection of both UK and overseas facing investments in order to balance out the risks of the election outcome.