6 questions you should know the answer to before you start investing

The most common question I get asked is, how do I invest? However, I am here as a friend to tell you that it’s really not by force. If you fit into the following categories then you will need to find a way to save money and get your finances in order first:

- You have no disposable income each month

- You owe several people money and have to avoid them so they can’t keep asking you for it

- You have no emergency savings

- You have high interest rate debt to pay off (if the returns you make on investments wouldn’t cover the rate you are paying on the debt then it makes sense to pay it down a bit first)

I would generally encourage you to have some level of savings just as a cushion before you start investing. Also it makes sense to create a budget so you have an idea of how much you are willing and able to invest. About 40% of my salary goes straight into various investments each month because I have budgeted and planned in advance. Most of it is by direct debit so I don’t even need to think about it.

Okay, now we have established whether you should be investing in the first place, you should ask yourself the following six questions before you invest your money:

1. Am I Diddy rich?

If you are not Diddy rich, and indeed most of us are not #momoneymoproblems – then you probably have limited capital available and will therefore need to start off investing with smaller amounts of money. This means potentially investing using a roboadvisor and fund/ETF platforms which allow you to invest from as little as £25 a month. The joy of these is that you can set up a monthly direct debit and not even have to think about the ins and outs of actually investing. There are a range of exciting new companies like Wealthify, Moneybox and Nutmeg that you can set up accounts with. I personally have a Nutmeg account which is straightforward to use, especially if you are new to investing. You can create a pot of money with a set goal in mind (mine is called Wedding/House Pot) and then set a number to identify what level of risk you are willing to take on a scale of 1-10. They then invest the money into their funds. You can also specify if you want your money to go into a socially responsible portfolio where there is more of a focus on making sure it is used to invest for a positive impact in terms of environmental, social and governance issues – things like climate change, privacy/data security and board diversity in companies.

2. How does the investment work – do you understand it well enough to explain it to someone else?

In the same way that I don’t buy gadgets that I don’t know how to use, I would not advise investing in complicated derivative type products that you are unable to fully comprehend. Broadly speaking the main types of investment are:

- ISAs – Individual Savings Accounts that are exempt from tax on their returns. These have a limited amount you can put in each year and can be either just cash or stocks & shares.

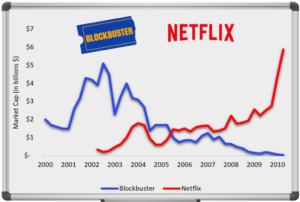

- Stocks/shares – these investments buy shares in a company that are traded on stock exchanges. The idea is that if the value of the company goes up then so does the value of your shares and hence your returns woo. Awkwardly, companies can also go down in value and leave you with nothing… Take Blockbuster as an example, people really used to go somewhere to rent DVDs/Videos to watch and then return them and pay for the service. That is until streaming services like Netflix et al came along and destroyed their business models.

- Fixed income/bonds – loans that are made to large organisations like governments or companies. The interest payments go to you and they are generally less risky than equities as the interest income is set at a fixed rate.

- Alternatives (Infrastructure, property, commodities etc) – Infrastructure covers the basic physical systems of a business or nation such as transportation, communication, sewage and large projects like building airports, housing and hospitals. Property can be either commercial (business properties) or residential (people live in them). Commodities are goods such as agricultural products, precious metals and oil.

- Funds – I think these are one of the easier ways of investing in assets. A fund manager buys them and manages them in a big bucket on your behalf. You can then buy parts of this bucket (called units). It essentially means you get a diversified portfolio without having to worry about all the different items that are being held within the bucket. The different types include mutual funds and exchange traded funds.

3. What are your goals? Are you looking for capital preservation, income or growth from this investment? Or even a combination of all the above

I don’t know your financial goals, but mine have ranged from ‘buy a flat with cash’ to ‘make money moves’ to ‘copping a Ferrari’. Whatever your goals are, you need to think about the timeline. If your goal is to buy a car next year then you probably shouldn’t be investing in the stock market because the volatility over a year would mean your investment is more likely to fall in value. Short term goals are more suited to a basic savings account with a good interest rate. Anything over five years would warrant potentially riskier investments.

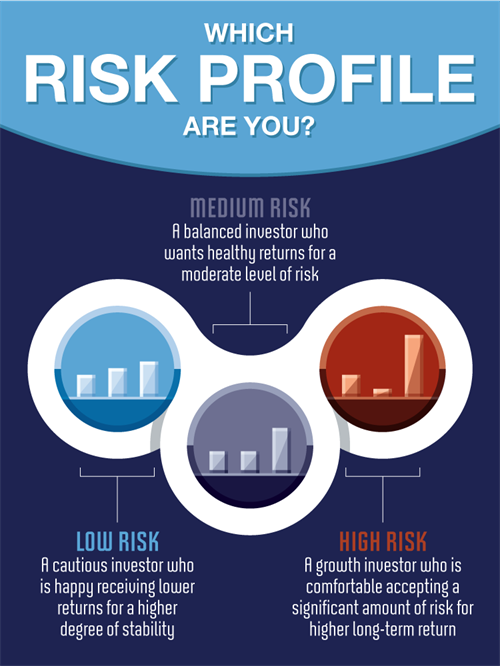

- Preservation in investing is when you are just trying to maintain the initial amount of money. This is normally followed by cautious investors with low risk appetite (basically people who don’t want to lose any money and don’t want to take risks to make a lot more money)

- Income investments do what they say on the tin – they provide you with a set amount of income on a timely basis for example each month to supplement your salary

- Growth is when you are aiming to increase the value of your initial investment over time

4. What are the risks of this investment? Are you comfortable taking these risks?

Different investments have different levels of risk. For example, equities have greater risk than bonds. The higher the risk, the higher the potential level of returns. So whilst a cash ISA may not sound very exciting, in the event of an economic downturn you know that your money is safe. However, if the majority of your assets are in shares, then a plunging stock market could see your investments lose a lot of value. Ultimately your preference comes down to what type of investor you are, risk averse or risk seeking. My general rule is that the younger you are the more scope you have to take risks. If you minus your age from 110 then that tells you the percentage of assets you should potentially have in riskier assets. I’m 24 so pretty much most of my investing is in risk assets. My view is always to invest over the long term which means I am not overly fussed about day to day movements in financial markets as far as my portfolio is concerned.

5. How much do you expect to earn on this investment? Is this realistic?

This question makes me think of the quote from Warren Buffet, ‘No one wants to get rich slowly’. It’s true, in a world where we have instant access to everything, the idea of waiting years for our investments to provide hefty returns sounds, well boring. Yes there are stocks that have gone up 180% in a year, but it generally wouldn’t be advised to put all your money into one asset like this. Diversification is key. So how much can we expect to earn realistically? Looking at 30-year return forecasts for different asset classes, equity markets are around 6% on average, commercial property 5% and bonds 1%. So realistically your portfolio probably won’t generate a ridiculously high return over one year, but the joys of compounding mean that if you stay invested in the markets for a long time, you are more likely to see better returns on your investments.

6. What are the costs to buy, hold and sell the investment?

Different investments have different costs. Buying property for example can incur fees such as stamp duty, solicitor costs etc. You will need to check what taxes you are liable for on disposal of certain assets. With funds there can be entry and exit fees as well as performance and management costs. Fund platforms generally charge fees for any funds you deposit so you must always check and choose investments with fees you are comfortable paying. One thing that I’m finding quite exciting at the moment is that a lot of trading platforms are removing fees so you can basically buy shares on the stock market without having to pay commission. Revolut – and soon RobinHood – offer free trades in the UK.

It’s great if you were able to go through the questions above and think through potential answers. Investing doesn’t need to be scary or complicated, there are lots of tools out now that make it a lot easier. Let me know if you decide to take the plunge – it’s really rewarding when you start to see returns.

If you would like to set up a Nutmeg account to start investing in an easy way I have a link that gets you a discount on fees for 6 months and I also get a reward! You can find out more here.

Read about why I shouldn’t have opened a help to buy ISA.

Rachael

5th December 2019 at 8:38pm

A lot of useful and relevant info on investing in one place, and without the jargon! Great post!

Ebele Nwangwu

Author

20th December 2019 at 3:50pm

Thank you so much Rachael, so glad you find it useful!