The Property Cycle

I listen to a lot of podcasts – mainly around different topics on investing. If you aren’t really into podcasts or are looking for some new ones to tune into then I recommend listening to ones that cover interesting topics like The Property Podcast with Rob and Rob (shout out to Nish for recommending it all those years ago). Every week I find out insightful new information about investing in property from them and on one episode they had Mark Morris – a property expert with experience spanning two decades – come on to share his wisdom. You can listen to the podcast here.

On this particular episode Mark gave some insight into what he would do differently if he could go back in time. One of the things he mentioned was having a better understanding of the basics – like getting to grips with standard terminology, goal-setting (read about mine here) and having a grasp of the fundamentals of the 18-year property cycle.

‘When you start with a good understanding of things like the 18-year property cycle, you can invest with a lot more comfort. When I started understanding the 18-year property cycle I almost felt like I was investing risk free..’

– Mark Morris

I posted a poll on Instagram and you guys voted to have an article on the property cycle, so today I will be covering what exactly it is and what it means for you and the way you invest.

Market Cycles

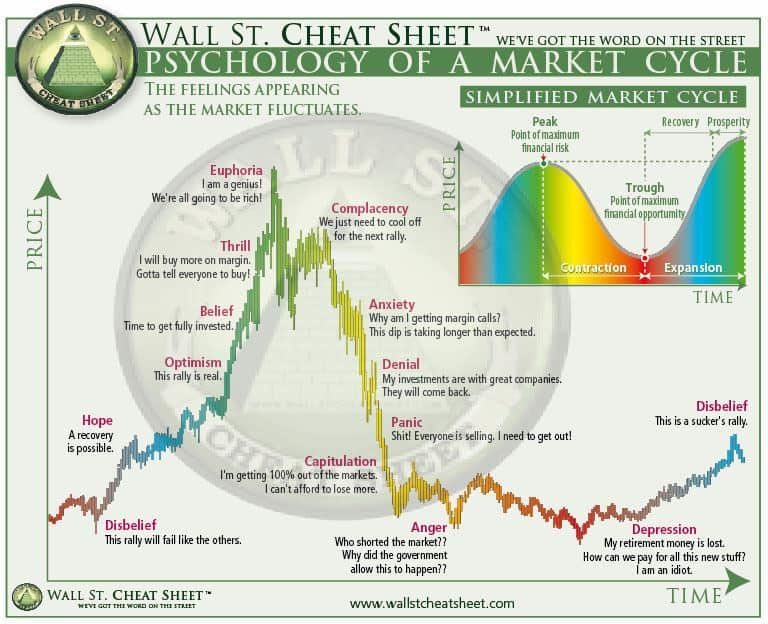

Most asset classes go through times where they are worth a lot and where they are worth not very much. The process from start to finish is known as a cycle. I normally talk about stock markets and the diagram below illustrates the cycle really well:

The two main trends are either when things are going really well (bull market) or really badly (bear market). The markets are described using these two animals in relation to the way that they attack. A bull will push up with its horns, whilst a bear will claw down on you. As you can see, there are varying emotions that you may go through if you are invested in the markets at various stages of the cycle. For example if you are invested in the stock market in the current bear market that has been brought about as a result of COVID-19 you may be starting to worry about the loss in value of your assets. One thing to remember with cycles though is that the bottom is normally higher than the previous bottom. So in theory we may go through a very bad market crash, but your assets will still be worth more than they were after the last market crash.

The 18 Year Property Cycle

What is the property cycle?

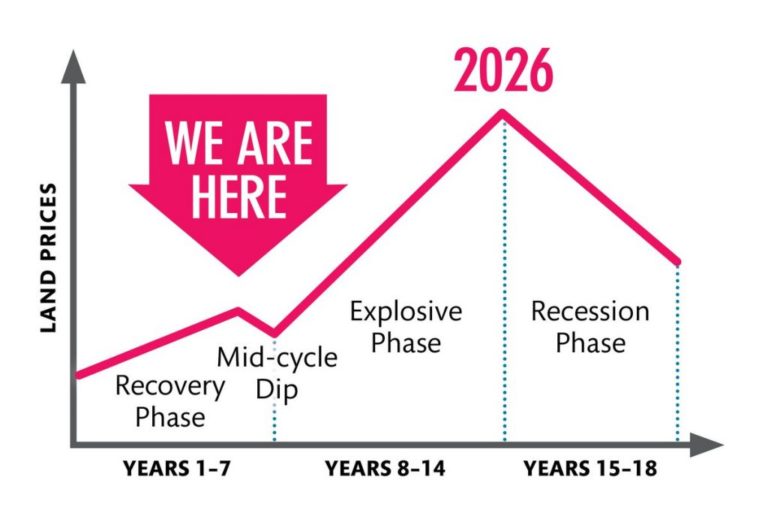

In the same way as financial markets rise and fall, property prices also do the same. Whilst it may seem that property prices just rise indefinitely, they actually go through a cycle of their own which is linked to the price of the land that they are built on. The wages we earn also have a significant bearing on property prices. If prices rise too high, then people are unable to afford properties and the fall in demand can lead to a crash. The 18 year property cycle is a theory that was proposed by the economist Fred Harrison and you can read about it fully here. It’s interesting because he was able to accurately predict the 2009 crash using his analysis of previous years of data.

The idea is that in the first 14 years of the property cycle we see good growth. These 14 years of growth are split into two sections. Years 1-7 where growth rates are approximately 5-6% per annum and then years 8-14 where we begin to see much more significant double digit growth. In between these two sections, there is a mid-cycle dip. At this point, lots of people may think that we are about to see an extended crash and go through those emotions I mentioned earlier (that we see in the stock market cycle), where they worry about losing a significant amount of money. However, according to the theory it would make sense to hold on and ensure you gain the benefits of those double digit returns (10/11%). This explosive phase is obviously a great place to be in, but you have to be careful, because making a purchase two years before the recession phase could see you lose a significant portion of the value of your property over the short term.

So how should I invest?

If you are planning to buy property, then according to the theory I suppose you would want to avoid making a purchase in the final two years before we reach the recession phase. In our particular instance, this would mean making sure that you do not buy any property between 2024-2026. If you can start to make purchases now and next year, then you could benefit from what is likely to be an explosive phase of growth.

Conclusion

The 18 year property cycle is of course a theory and there may be slight variations in the outlined timings. Also, it is important to bear in mind that the bottom of a cycle is normally higher than the bottom of a previous cycle. This means that if you are investing for the long term then it doesn’t matter too much when you make your initial purchase as you will have the asset over more than just the recessionary period. However, when it comes to managing risk and liquidity, it can be useful to have an idea of the general market cycle and how you can position yourself at various points within it to ensure you are in a good position. You don’t want to be loaded down with too much debt during a recession, if you have a lot of financial obligations to fulfill.

Let me know what your thoughts are on the property cycle and whether you are hoping to purchase any property soon!