Coronavirus – What happens when the world gets sick?

Take me back to the good old days – when double dip was only used in reference to the sweets and Corona was just a cold beverage for a sunny day, not a rampant pandemic.

So, what on earth happened last week?

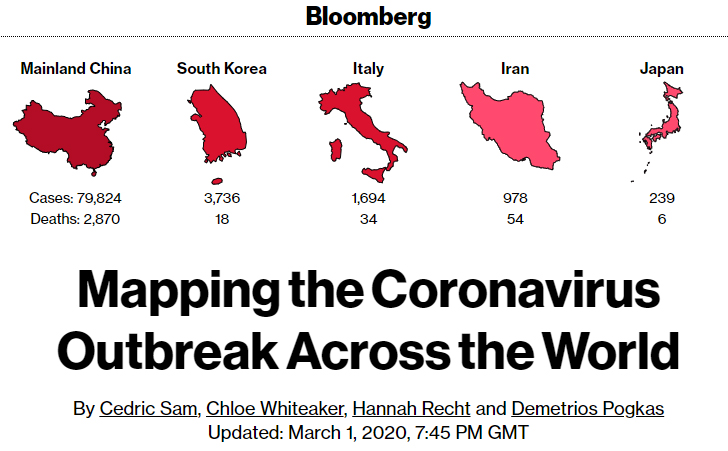

Basically the virus COVID-19 (which up until recently had been seen as pretty much a China-specific issue) spread to several countries around the globe. The mortality rate appears to be quite low (around 2%) with most deaths occurring for people who are elderly or already had underlying respiratory issues, but it appears to have had a massive impact on sentiment and people’s day to day lives right around the world with office/factory lockdowns and people donning face masks in public areas.

Another Pandemic

First and foremost, this is a very sad situation and I am praying for those who have lost loved ones to disease and illness. The human impact of this disease has been significant and I really hope a suitable vaccine is found soon, or – like SARS in 2003 – the virus simply runs its course and goes away as policies of quarantine and screening are followed. The ‘Netflix Explained’ series has a great episode on Pandemics where they talk about how every year there are five new emerging diseases on the planet. One of the contributors candidly says, “There are three things in life that are guaranteed – death, taxes and flu pandemics.” This serves as another reminder to us to look after our health because it really is the foundation that allows us to do all the things we want to in life. There are some guidelines from the World Health Organisation on how to keep yourself protected which you can read here.

There are also of course implications for economics and investments. I have identified three main ones:

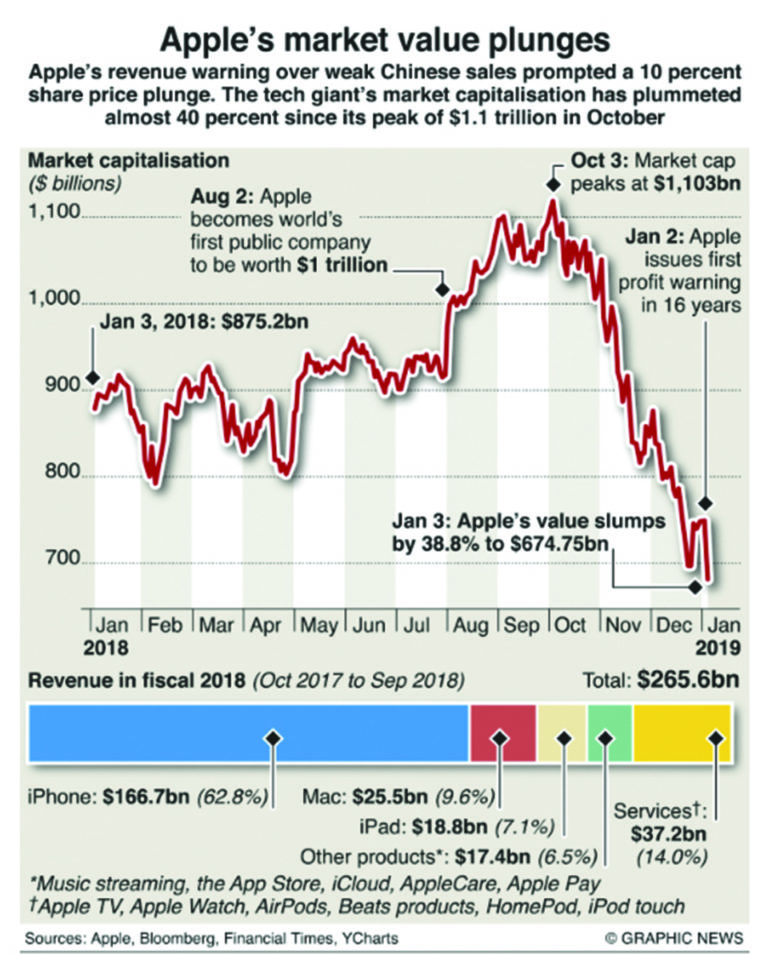

- Supply chains have been disrupted – the global economy is now far more intertwined than it ever has been. Products are made from parts that are sourced from all over the world and even one missing component can stop a final product being made. China is a large contributor to global manufacturing and the shutdown of factories has caused issues for companies from Apple to Jaguar Land Rover.

2. Economic growth has slowed – the virus has resulted in people staying at home and therefore not travelling abroad or going out to buy things. This has seen retail, airline and leisure companies struggle as less money is spent. This is particularly significant as the Chinese middle class is a large percentage of global consumption.

3. Stocks have plunged – financial markets hate uncertainty and it doesn’t get more uncertain than a new strain of virus that is spreading at an uncomfortable rate. We have seen some of the greatest falls in stock prices since the global financial crisis.

Is there any good news?

In all this mayhem, surprisingly there are some people who have actually benefited. Companies that supply face masks and surgical gloves have seen their share prices rise in value along with pharmaceutical firms who appear to be making headway to create a vaccine against the disease. There is also potential for firms that are aligned with e-commerce trends to do well because people are staying in their homes and increasingly carrying out more of their consumption online. In addition to this, the shutdown of several offices around the world has increased the importance of video conference call software and so Zoom for example has seen a significant boost to their share price. This probably opens the door to wider discussions around the necessity of large offices given the advances in technology which make working remotely so easy.

I have had lots of people asking me questions around what all this means for investing now. I will answer the top three here:

Should I buy the dip? (And what about market timing?)

- If you are convinced that the virus will be contained and that supply chains haven’t been disrupted too much then go for it. I would disagree at this stage though unless you are looking at specific stocks that now have a particularly more attractive valuation.

- I would be cautious about ploughing all your money into equities off the bat right now. It is probably more prudent to keep an eye on the number of new coronavirus cases and wait for that to level off before buying if that is the strategy you wish to use.

- Also, I am a strong advocate of a ‘buy and hold’ strategy utilising dollar cost averaging – (when the stock market goes down you think of it the same way you do a sale in a shop and continue buying assets systematically at what is essentially a discounted price). You can read an interesting blog post comparing the two strategies here.

- Trump has advocated buying the dip, but we have to remember that there is a presidential election coming up so it is in his best interests to see this happen (his view is that a large part of his value as a president is in direct correlation with stock market performance). Asset prices have been artificially high for a long time now, so this correction is actually healthy in some ways.

Does this mean there will be a recession?

- Even before coronavirus stepped on the scene there was some caution in markets around whether there would be a recession as we have been in a rising market for over ten years now (a cycle generally lasts 10 years on average) and economic growth had begun to slow.

- It will help to keep an eye on what we call ‘leading indicators’. These are data points that give an indication of where the economy is going. The PMI figures for example for China fell from 50 to around 37.5 (anything below 50 indicates that the economy is contracting).

What should I invest in now?

- If you are keen to buy individual companies then you may want to do some research into stocks that benefit from the trends I mentioned above.

- You could also use dollar cost averaging to start regularly investing in global equity tracker funds (the fees are generally low and your investment basically goes up and down in line with markets).

- EM equities (China specifically) – the number of cases has levelled off and economic growth looks like it will slow, but the government has a lot more room to cut interest rates and stimulate the economy than developed economies. This means we could see a strong bounce back over the second half of 2020.

What happens next?

My mentor (a fund manager) told me that he had a discussion with a virologist who said it is likely that 60-65% of the world will contract COVID-19 and that if you live in a large city and use public transport you will almost definitely get it. However, if you are fit and healthy to begin with then it should be no worse than common flu. I think that whilst a lot of the headlines from the media have been quite inflammatory, we should be conscious that more people will contract and unfortunately die from this virus as they do with flu in any standard year.

The main parallel I have to draw is with SARS in 2003. Back then we saw a decrease in the number of cases and then came some monetary stimulus from the Chinese/Hong Kong governments which helped the economy. However, the impacts from COVID-19 are likely to be worse because global supply chains are far more interconnected now (which affects supply of goods). Then on the demand side, China now accounts for a much larger proportion of world consumption than it did back then. A slowdown in people buying things (consumption) means that we are likely to see a much more significant and protracted economic impact which would ultimately result in a recession. I do not think it will be as bad as the global financial crisis though, due to the fact that people are less indebted now (it is mainly governments that hold large amounts of debt).

How have I positioned my portfolio?

In light of my view that I think this will be an issue that gets much worse before it gets better, I take this as an opportunity to preserve some of the returns I have already made by shifting some of my investments into ‘safe haven’ assets (which are less risky and should help me to just preserve my money). However, I also think over the next few months this may be a good opportunity to buy equities in a systematic manner. Timing the bottom is difficult, but I think as we begin to see a stabilisation in the number of virus cases then that is the time to begin to take advantage of dollar cost averaging. My view is that every month you should buy equities/mutual funds and over the long term (15 years plus) you benefit from the returns. Right now, we could see an escalation in the number of cases and that would just result in further market falls so I think it makes sense to wait for some sort of order to return. We have had more than 10 years of a bull market and it was bound to end at some point, I just don’t think any of us imagined that this would be the catalyst.

Do share any comments you may have, it’s always good to hear other people’s viewpoints!

DISCLAIMER: I am not a qualified financial advisor and this is not financial advice. I give general guidance and share my views and thoughts on the markets and am not liable for any losses incurred as a result of any decisions taken from this post. Mention of a specific stock should not be taken as a recommendation to deal. Remember when investing the value of your investments can go down as well as up.

Femi

4th March 2020 at 7:59pm

Great work..

Could you please share some thought on fintech

Ebele Nwangwu

Author

25th March 2020 at 7:06pm

I will write a post! Any specific topics/companies you would like to know more about?

Chima

20th March 2020 at 8:25pm

Awesome, I agree with you. I am also of the opinion that we need to observe the trends before investing further, knowing that there is a possibility that the pandemic may linger on for a while.

Ebele Nwangwu

Author

25th March 2020 at 7:05pm

Yes, we have seen a strong monetary policy response from central banks and markets have shown some positive signs, but ultimately this is having a massive impact on the economy – the full extent of which is yet to be realised!