How I got a perfect credit score

When I think about the financial aspects, the society that we live in is both a blessing and a curse. A blessing in the sense that we generally have free movement of capital (money) and the means for people that need money (borrowers) to get money from those that have a surplus of it (lenders). So it generally works like this: you want to have that new Mercedes with a ‘19 plate? It’s yours! Want to go to university for three years to study for a wotless degree? Here’s the money, go for it! Want to own a property and be indebted for the vast majority of your life? Well why didn’t you say so? Take this mortgage! Of course, people don’t just lend out of the goodness of their hearts. Banks, loan sharks and all sorts of other businesses make money from charging ‘interest’ which is essentially the cost of borrowing. Their main issue is making sure that you are capable of paying back the loans that they provide. Think of it this way, have you ever lent a friend something and not got it back? Well if you had a way of checking if they had borrowed from people in the past, whether they had given the item back and how long it took for this to happen, this would be quite useful for you. You could then just make the decision to not lend them the item. Well this is what happens in the ‘real world’. When you make applications for loans, firms can charge you higher levels of interest if they feel you are unlikely to pay them back. Conversely, if you have a good track record then you are able to have access to more attractive rates. Your ability to pay back loans and credit is calculated and assigned a credit score.

Your credit score can determine whether you get approved for loans such as a mortgage to buy a house and so is quite important. It is generally calculated by looking at a few elements:

- Payment history – Paying your bills and on time

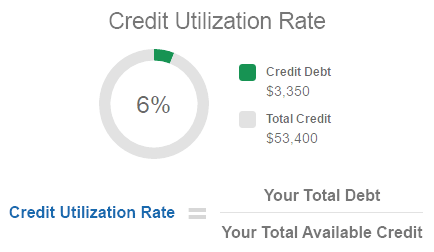

- Credit utilization – The amount of available credit you’re currently using

- Credit history – How long you’ve been using credit

- Credit mix – How many different types of debt you are using

- New credit – How often you’re applying for new credit Note that there are different companies that generate score reports and they differ in terms of the elements that they place particular emphasis on. One company may place a higher weighting on your credit mix, whilst another may place more importance on your payment history.

For me personally my credit score was originally not in a perfect place. Not because I had lots of payments I had defaulted on but simply because I didn’t really have a credit history. It may seem that not ever borrowing is the best way to show you are good with money, but actually you need to build up a track record so firms can see you have been able to manage your finances well. Over a period of three years I have essentially reached and maintained a ‘perfect’ credit score by following these seven tips:

1. Get a credit card – This was probably the most important factor for me personally. When I first checked my credit score it was at an okay level, but I knew that I wanted to purchase property in the next few years and so it made sense to get it to the best level possible to make that whole process easier. I made an application for the British Airways American Express card because I had an acquaintance that had a referral program that meant we would both benefit from the bonus points to get discounted airplane travel. Getting a credit card is one thing, but using it responsibly is another, so make sure you spend amounts that don’t lead to financial distress.

2. Limit credit applications – If you have more lines of credit open then of course you have a higher amount of available credit, but if you apply for lots of different accounts at once then these ‘hard enquiries’ can be detrimental to your credit score. Think about it from the lender’s viewpoint, if someone is applying to lots of places for loans at any given time it can look like they could end up in some financial distress that would stop them from paying the loans back. It makes sense to just try opening one credit account at first and ensure that you make these payments consistently. Then, when you feel confident about your position you can apply for more types of credit. I have one credit card that I do all of my budgeted spending on and pay it off completely at the end of each month. It can be tempting to just pay minimum amounts, but the best way to avoid unnecessary charges and show your financial capability is to cover the full amount.

3. Minimise credit utilisation – My allowance was around £6,000 when I first got my credit card. I usually have a budget for the month (which I generally stay within) and I stayed around the 20% utilisation mark. If you use a lower percentage of your allowance, then this is generally looked upon favourably. After about a year the card company increased my allowance to £14,000. As exciting as it may be to think you have access to more money, it makes sense to keep your utilisation low even when your allowance increases. Now my utilisation rate is around 10%. The key to keeping your utilisation low is spending less money. As simple as that sounds it can be very difficult, but it is doable – especially now that we have access to apps on your phone to track what level your spending has reached. I like using Excel and so I have a budget tracker to guide me each month.

4. Prove where you live – Register to vote (get your name on the electoral roll) as being on the electoral register helps companies confirm who you are and where you live and makes them more comfortable about lending you money. Then of course make sure you are using this address for any lines of credit you may apply for and bills that you pay.

5. Make payments on time – set up direct debits. I’ll be honest, I don’t pay any utility bills – I live with my parents – #millenniallife – and they run the house finances and I contribute some money. However, the payment history aspect of your credit score includes all of your loans – so a missed credit card payment could count the same as a missed payment on your mortgage. Missed and delayed payments will have an adverse effect on your credit score and generally account for a large weighting of your credit score. I find the best way to manage any monthly payments that I have is to set up a direct debit so you don’t even need to think about it and there is no risk of forgetting.

6. Manage your debt – If you have a high level of debts, this can have an adverse effect on your credit score. Luckily for those of us who took out loans for university, student debt does not have any bearing on your credit score so this should not be a worry. Any other loans that you do have though should gradually be paid down over time to improve your lendability.

7. Have patience! Once you have made all the changes you can, you will need to wait it out. It takes a while for these things to filter through to the information that is held on file about you. So I would not recommend frantically checking your credit score every week – I check mine maybe twice a year. Having said that, you are free to check it as often as you like and this will not have any adverse impact on your score.

If you would like to check your credit score then there are a range of free providers you can get a free report from. I use Experian and you can find a link to their website here.

If you would like to use the British Airways American Express scheme that I signed up to then you can access that here.

For some people all this stuff may seem very straightforward, but I think our education system fails us in some ways because there are people who really have no idea when it comes to things like this. If you don’t have people around you who know and can inform you of these things and you feel overwhelmed by all the information on the internet it can be tricky. For those of you who needed that bit of extra guidance I hope you find this useful, please let me know how you get on – good luck!